Table of Content

- If you’re a homeowner struggling to make housing-related payments due to the pandemic, help is available or coming soon

- Factors That Go Into A Credit Score

- The Cost of a Low Credit Score

- What credit score do you need to buy a house?

- How much should my down payment be?

- Understanding How Credit Scores Impact Mortgage Rates

The institution will require you to maintain a set amount in an account to offset any activity on the new account. Derogatory items don’t disqualify a mortgage approval. Generally, it’s only required that they’re historical events and not current ones. For example, you can get approved for a mortgage if you’ve declared bankruptcy in the past, or if you’ve lost a home due to foreclosure. Fortunately, it’s possible to boost your credit score.

Your credit score determines a great deal about your future financial leverage. In order to get the best terms, conditions, and interest rates on a mortgage, you’ll need a categorically good credit score of at least 670 to pursue your dreams of buying a house. Using these tips, you’ll be able to step into the market with the knowledge and credit confidence you need.

If you’re a homeowner struggling to make housing-related payments due to the pandemic, help is available or coming soon

Because you're borrowing more money to purchase a home, there are often stricter qualification requirements, like having a much lowerdebt-to-income ratio. This is because you'll be seen as a risky borrower if your file indicates that you're taking on more debt than you might be able to comfortably afford. To ensure you're spending as little money upfront as possible, be sure to find out your lender's minimum down payment amount ahead of time. A jumbo loan, or jumbo mortgage, is a loan that exceeds the borrowing limits set by the FHFA. Paying your bills on time is something you can automate amidst the digital age. Where possible, set up auto-payments so you never fall behind on your bill payments again.

Additional factors can determine whether you'll be approved for a mortgage, including your income and assets, as well as the loan-to-value ratio and your debt-to-income ratio. A free credit report does not show a lender enough information to approve you for a mortgage loan. This type of credit report shows what is called "consumer credit." Consumer credit uses a different scoring model to rate an applicant for a retail credit card or a car loan. Your credit score isn’t the only factor for mortgage approval. However, it’s a key indicator of your financial health. Track your credit, make on-time payments, and get help to choose the home loan that’s right for you.

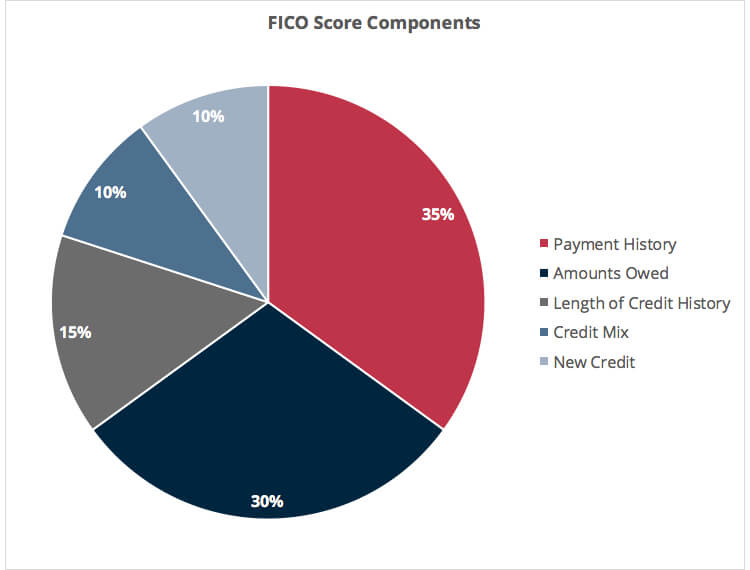

Factors That Go Into A Credit Score

It’s recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won’t be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments. Even though buying a home is the reach here, there are specific financial goals you should strive to maintain.

With a 10% down payment, a 620 borrower will pay 1.1% in PMI, according to Joe Parsons, a branch manager and senior loan officer at Pinnacle Home Loans in Dublin, California. Regardless of what kind of home loan you're considering taking on, keep in mind that the type of loan and loan amount need to make sense for your financial situation. While a jumbo loan can make it easier for you to purchase a more expensive house, you should always remember that the money needs to be paid back with interest. The larger your loan is, the higher your monthly payments will be and the more you'll pay in interest over time. However, many homes on the market go for way above this price — especially if you live in a higher cost of living area like San Francisco or New York City.

The Cost of a Low Credit Score

Interest rate and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.S. Lenders ask these questions to get comfortable with you. Your financial health isn’t the only consideration lenders make, but how you manage your bills tells a large part of your story. These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health. USDA loans are government-backed mortgages available for homes outside of densely-populated areas.

The USDA program covers about 91% of the U.S. including rural areas, small towns, and many suburbs. Our advice is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website. Have experience with working on your credit score to buy a house? Let us know in the comment section below what you did to reach your goal.

In fact, FHA loans don’t require home buyers to have a credit score at all, although many lenders want to see a minimum score of 580. Your credit score not only qualifies you for a mortgage. It also helps to determine your interest rate and loan terms. If you have poor credit, taking the opportunity to improve your score can help you land a better interest rate and a longer repayment term. This, in turn, could give you a lower monthly mortgage payment or reduce the amount of interest you pay over the life of the loan.

O get your credit utilization, simply divide how much you owe on your card by how much spending power you have. For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%. There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models.

To make his point, he shares misleading information about what goes into a credit score, with the names of the scoring criteria conveniently changed. His advice on credit scores is one of the most problematic examples. Although the conventional wisdom is that you should work on increasing your credit score, Ramsey says to do the opposite. He recommends going lower, so low that your score disappears. And there are people who follow this advice, calling in and asking Ramsey how they can get a credit score of zero.

There is a $40 fee, which is added to the monthly payment. The monthly payment on a 30-year mortgage of $200,000 at 3% interest would be $843, without taxes and insurance added in. Those two areas would add about $150 a month, depending on where you live and other factors. At 4% interest, the payment is $954 before interest and taxes. Over the life of the mortgage, the cost with interest alone is $303,601 at 3% and $344,016 at 4%.

That’s the minimum credit score requirement most lenders have for a conventional loan. With that said, it’s still possible to get a loan with a lower credit score, including a score in the 500s. As mentioned before, your credit score plays a significant deciding factor in your home buying potential. The healthier your credit, the more options you’ll have available to you. The minimum credit score needed to buy a house varies by loan type, location, and lender.

Mortgage lenders go further than credit card companies to determine if you’re a good risk for a mortgage. It’s useful to understand how they use your FICO® scores as you plan ahead. If you have credit card debt, transferring it tothis top balance transfer cardsecures you a 0% intro APR for up to 21 months! Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

Lenders set their own minimum requirements by loan type. Because of this, you should carefully consider whether or not you can afford the payments on such a large loan. If the numbers don't fit into your budget, this could be a sign for you to consider opting for other less hefty loan types, like a conventional loan. Among Credit Karma members with mortgages, baby boomers has the highest average credit score at 724. Older generations tend to have higher credit scores, likely because they’ve had more time to work on their credit.

And these are the states with lowest average mortgage balances. Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

No comments:

Post a Comment